Alterra Lenders focuses on financing in order to underserved groups into the 34 states plus Washington, D.C. It financial can help you score financing if you are a first-day homebuyer, is actually mind-employed, reside in a household having multiple resources of income, need assistance which have a down payment, or lack a personal Safety amount, otherwise require a spanish speaking financing administrator.

Article Independence

As with any of one’s home loan company evaluations, our very own study isnt dependent on one partnerships or advertisements dating. To learn more regarding the our very own scoring methodology, click.

Alterra Home loans Complete Comment

Alterra Lenders is a home loan company which had been created in 2006 and is today element of Opinions Home loan Category. The fresh new Vegas-centered lender offers numerous loan affairs for almost all models out-of try the website individuals, together with folks who are care about-operating, need assistance due to their down-payment, or provides money from numerous supplies.

While the a hundred% Hispanic-possessed providers, Alterra’s objective report says they strives to simply help underrepresented citizen groups. The business claims 73% of their customers had been diverse and you can 62% had been first-go out consumers from inside the 2019. Some of the lender’s loan officers was proficient in both English and you will Foreign-language, which can only help multilingual users browse this new homebuying process.

Alterra Home loans: Mortgage loan Items and you will Items

Alterra Home loans also offers mortgages getting borrowers looking to buy, redesign, otherwise refinance a home. For the lender’s selection right now:

Alterra also helps consumers because of different homebuying difficulties, as well. By way of example, their underwriting design accommodates borrowers that are thinking-employed otherwise who happen to live into the home where several nearest and dearest contribute for the monthly bills.

The lender even offers a different federal loan program where individuals are able to use a single taxpayer identification count (ITIN) in place of a social Security amount. So you’re able to qualify, individuals should give an effective 20% downpayment, reveal a couple of years’ property value employment in the same brand of work, and offer their a few newest taxation statements using the ITIN. Such mortgage brokers come that have a higher interest rate.

Alterra Lenders: Openness

Alterra Family Loans’ website does not encourage home loan costs otherwise lender charge and will be offering hardly any information about its offerings. Customers would not pick details about the sorts of financing Alterra has the benefit of, facts about degree conditions, otherwise useful resources regarding home loan processes.

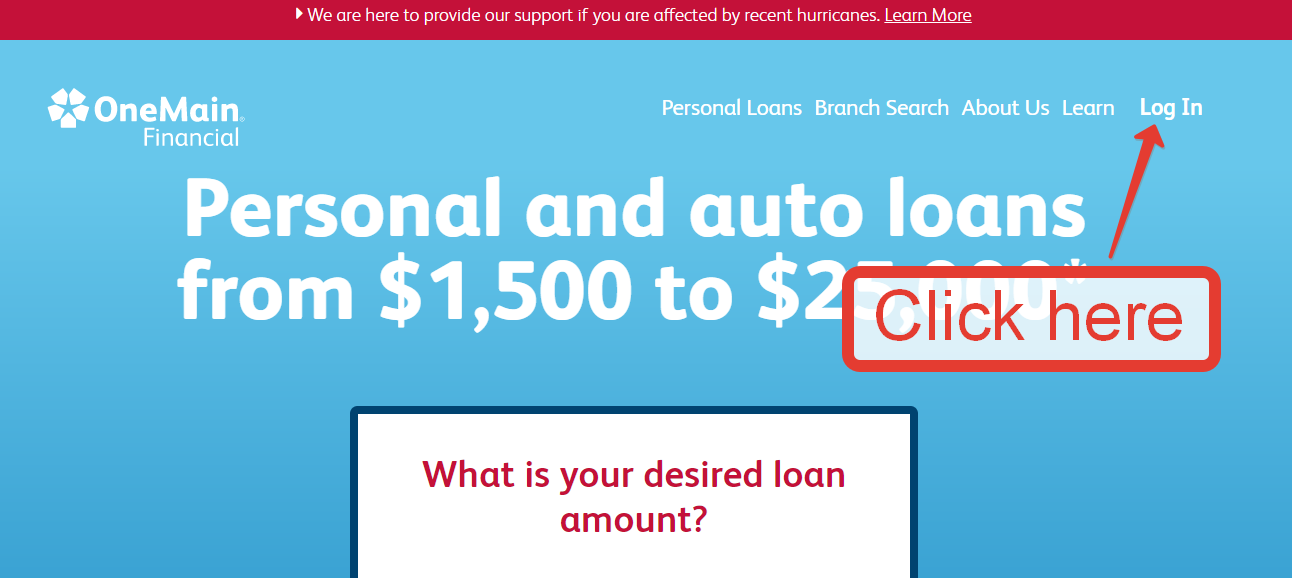

Borrowers can be fill out an online setting so you’re able to demand a phone label off financing manager otherwise capable see one of the brand new lender’s when you look at the-person branch practices. I attempted contacting the lending company several times and did not apply at anybody, however, we did located a visit-back out of that loan manager immediately following filling in the net function. The brand new affiliate offered information about the mortgage techniques and you will considering a beneficial price quote instead a difficult borrowing from the bank remove.

If you fill out a mortgage app, you might fill out you to definitely on line or through the lender’s mobile app, Pronto As well as. Financing manager usually contact one arranged a merchant account and you will finish the loan acceptance techniques. You can tune the application, upload files, signal paperwork electronically, and you can verify your own a position on line.

Alterra Home loans: Mortgage Pricing and Fees

Alterra Home loans doesn’t encourage rates of interest towards their site otherwise bring a list of costs individuals you are going to pay at the closing. Yet not, it ong extremely loan providers. You may pay in the dos% so you can 5% of the residence’s total cost for the charge, plus lender costs and you can and you will third-group will set you back. Will cost you range from:

- App and you can/otherwise origination commission percentage

- Credit report fees (optional) prepaid will set you back

- Authorities fees

- Recording costs

Mortgage qualifications at Alterra may differ with each home loan program. In order to be eligible for a traditional financing, consumers need a credit rating with a minimum of 620 and a minimal advance payment away from step three%. But with FHA finance, borrowers you want a credit history regarding merely 580 with a straight down percentage of at least 3.5%. Alterra along with need a score with a minimum of 580 to locate a beneficial Va loan, if you will not need a down-payment.

Refinancing Having Alterra Lenders

Property owners having a current home loan might be able to spend less otherwise borrow money with a refinance loan. Alterra’s website doesn’t render far factual statements about this new refinance process otherwise bring resources and you may interest levels, therefore you’ll need to contact that loan officer for more information. Alterra offers:

, which allow you to get another type of interest rate, loan name, otherwise both. Home owners tend to use this sort of mortgage to save cash, reduce personal mortgage insurance policies, otherwise switch from a variable-rate mortgage in order to a fixed-rate loan. , which permit you to definitely borrow cash using your household security just like the security. You would pull out a mortgage for more than you borrowed, pay your current mortgage, then undertake the difference in cash.